Linking Aadhaar with PAN has become necessary as a result of your revenue enhancement come back wouldn’t be processed if your Aadhaar isn’t coupled with PAN. Also, if you have got to hold out a banking group action higher than Rupees fifty thousand (50000) you have got to induce your PAN and Aadhaar coupled. Linking PAN card with Aadhaar card is extremely straightforward and therefore the government has provided numerous strategies to try and do that, that you’ll comprehend more. The point in time for linking PAN with Aadhaar card is 31st Sep 2021.

Steps to link Aadhaar and PAN Card

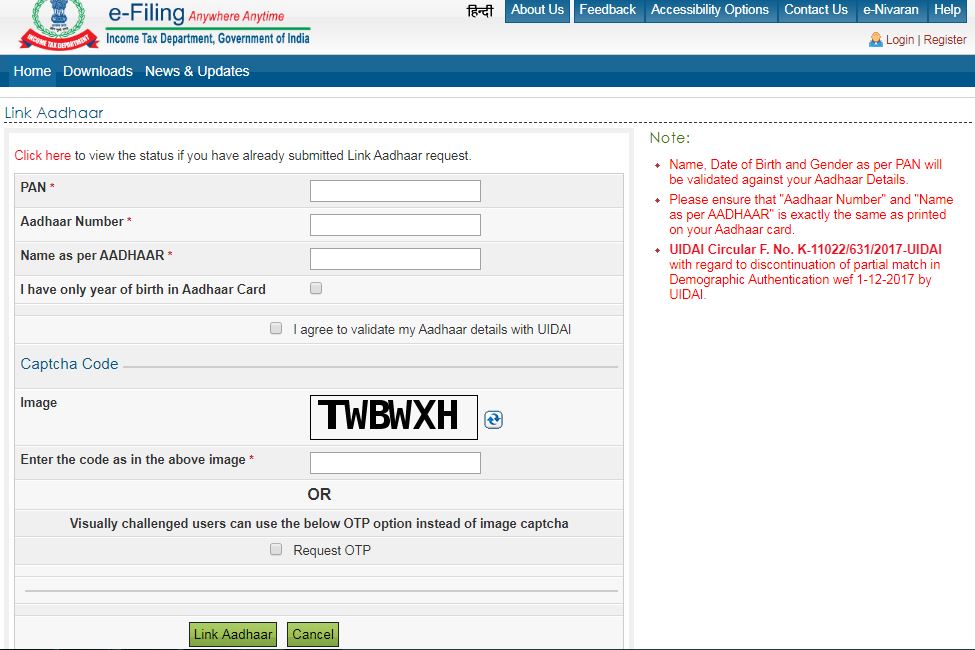

- Visit Income Tax e-Filing official website

- Enter Your PAN Card Number,

Enter your Aadhaar Card Number,

Type your name given in Aadhar Card - If you have only year of birth in Aadhaar Card,☑ Click the Check box

- Click Terms and condition check box ☑ (I agree to validate my Aadhaar details with UIDAI)

- Now Enter the CAPTCHA CODE. (For visually challenged people use OTP Option instead of Image code)

- Now Click Link Aadhaar button. (Your Details has been submitted successfully

Check whether your PAN Card is Linked with Aadhaar Card or Not

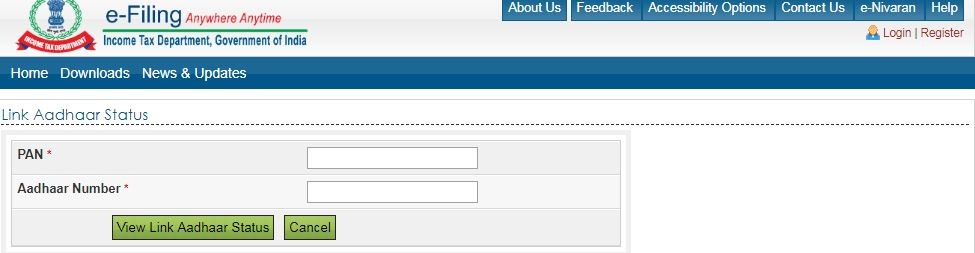

- Click here for Checking Status of your Aadhaar and PAN Card

- Now Enter PAN number and AADHAAR number

- Now Click View Link Aadhaar Status Button

Please link your AADHAAR Card with your PAN Card before September 31st 2021. So that your PAN Card won’t be blocked for TAX.

Frequently Asked Questions of Linking AADHAAR with PAN

How to link PAN with Aadhaar Card?

Go to official website of TAX E-filling and submit all the required details.

What is the deadline to link Aadhaar and PAN Card?

Government has increased the deadline of linking Aadhaar with PAN card till 31st September 2021.